Home prices have finally clawed their way back to the peak of the housing bubble. That's on averagenationally . The story is very different when you zoom in on different counties or cities in particular.

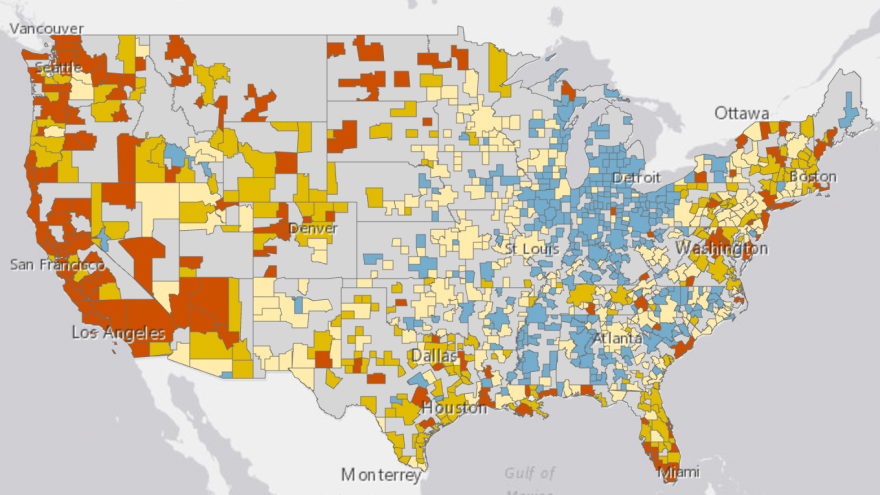

It's also a different picture if you adjust for inflation. A new tabulation of home price data by Harvard University's Joint Center for Housing Studies lets you do just that. You can zoom in on an interactive map to see what prices are doing in various parts of the country.

San Francisco, Nashville and Pittsburgh are among the 15 percent of housing markets around the country where prices have actually risen above their prior peaks in the mid-2000s after adjusting for inflation. Less fortunate are Cleveland, Phoenix and much of Florida, where prices are still at least 26 percent below where they were before the bubble burst.

In terms of how the overall housing market has been doing lately, it's recovering but not yet recovered, says William Wheaton, a housing economist at MIT.

"There's a lot of discussion right now about how sales should be more robust and they're not, given where we are in this stage of the economic recovery," he says. Americans are buying the same number of homes they were 18 years ago. And Wheaton says the population has grown since, so sales should be stronger.

There are many factors at play, he says. Young people are taking longer to settle down, get married and buy their first house. But also, "a large part of the activity in the housing market is what we think of as 'churn,' ... people who are buying one house and selling another," he says. "Churn is down quite a lot."

Housing economists say part of that is likely due to the fact that prices are just now on average returning to their pre-crash peaks (in nominal, or non-inflation-adjusted, terms). That means that in many parts of the country people don't have any or much equity in their house if they bought during the bubble or used up their equity with a home equity loan back then.

Wheaton says this is a big part of why he doesn't consider the market as recovered yet. He says not enough homeowners are "sitting on top of little nest eggs of equity and can say, 'Oh, you know, now we can go buy the house down the street we always wanted.' "

On a brighter note, at least some of the decline in people buying and selling houses might be due to something else. Americans are moving around the country a lot less than they used to. In fact, 25 years ago, Americans were more than twice as likely to pick up and move from one state to another.

"It's a huge difference in how people are moving around the country today than they did a generation ago," says Greg Kaplan, an economist at the University of Chicago.

Kaplan has done research that suggests a central reason for this change is that people don't have to move as often to find a good job that matches their skills.

"It used to be the case that if computer science was your thing and you wanted to be a software engineer, the best place for you to reap a return on those skills was to go to Silicon Valley," he says. "Now, that's probably still true today; it's just less true than it used to be."

So, Kaplan says, if you want to live in Kansas City or Phoenix, maybe to stay close to friends and family, there's a more diverse range of job opportunities in more parts of the country. Kaplan calls this "the decline in geographic specificity of occupations." That's a mouthful but, he says, it "basically means you can do everything everywhere." Or maybe not everything, but at least today people have more options.

There's another factor at work in the market right now: Realtors say a tight supply of homes is a problem in a lot of places. That's also related to the low churn rate that Wheaton talks about — fewer people selling their houses to buy other houses.

Put all this together, and probably the biggest reason the housing market isn't back to normal is that we still haven't quite gotten over the hangover from the worst housing crash since the Great Depression.

Copyright 2020 NPR. To see more, visit https://www.npr.org. 9(MDAwMTM1NDgzMDEyMzg2MDcwMzJjODJiYQ004))